My cheap car insurance blog 0857

AboutWhat Does How Much Will It Cost For An 18 Year Old To Insure A Bmw M3? Do?

On the other hand, 52% occur on Friday, Saturday, or Sunday. Teens and young people have the most affordable safety belt use rates of all drivers, a fact that increases their risk of injury if an accident occurs. Amongst teenagers who died in auto accident in 2019, almost half were not wearing a seatbelt at the time of the crash.

01 or greater, and 82% of those motorists had a BAC of 0. Whether or not a parent decides to keep their kid on their insurance policy, moms and dads ought to go over these risk aspects with their young drivers.

In 2019, 71% of all vehicle crash deaths were male. Still, it does not always be true that males pay more for vehicle insurance than females. While young males pay significantly more than young female drivers due to the statistical odds of a male being associated with a mishap, guys either pay the very same rate as women or a little less by the time they've hit middle age.

The reason ladies end up paying more at any point is unknown. Some states have actually begun to take steps to get rid of gender as a rate factor to consider. Unless there is a statistical reason to believe one gender is associated with more mishaps than the other, it makes no sense to charge another.

The Ultimate Guide To Cheapest Car Insurance For Teens

When we compared the average expense to guarantee a 35-year-old woman versus the expense to guarantee a 35-year-old male, there was only a $26-a-year difference, with females paying slightly less. Provided the large variety of excellent car insurer included in our analysis, $26 per year (or $2. 16 monthly) may be as close to even as is affordable to expect.

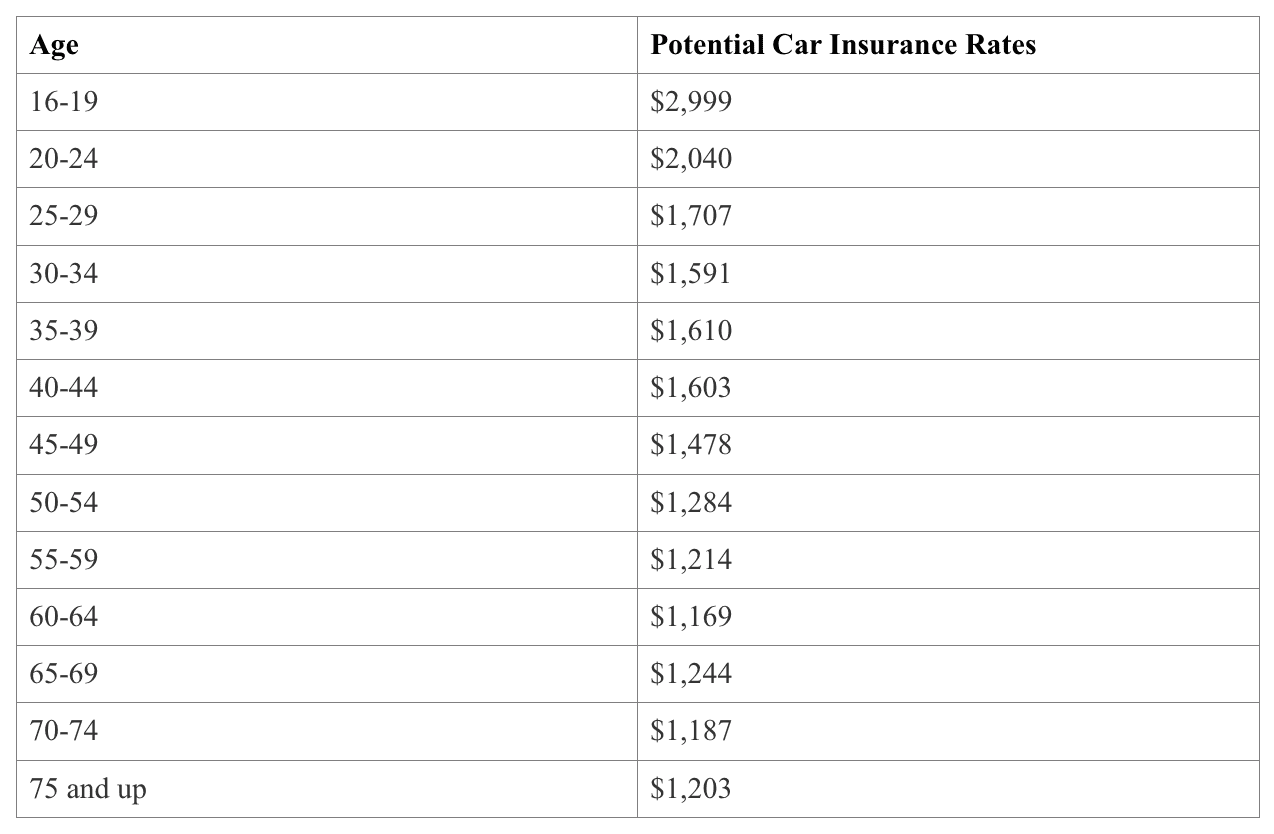

Typical automobile insurance rates by age and gender, As the automobile insurance rates by age chart revealed, young motorists pay more for insurance than older chauffeurs with clean driving records. What's intriguing is how various mixes of circumstances effect rates. For example, how do the rates of a young driver with a clean driving record compare to the rates of a middle-aged driver with a mishap on their record? Here, we'll look at the average national rates for various age and gender mixes.

Possibly one of those young drivers is your teenager! Moms and dads and guardians require to take the time to talk to teen drivers about the severity of driving securely.

They included a 16-year old teen to the policy. This is what they saw happen to the rates: The average home's cars and truck insurance coverage bill rose 152%.

What Does Adding A Teenage Driver To Your Insurance Policy - Njm Do?

According to the post, the factor behind the increase was due to the fact that "teenagers crash at a much greater rate than older chauffeurs. Insurance business have to prepare for that expected sustained cost of insuring the driver.

Generally, vehicle insurance provider will not interact what discount rates they use to teen motorists unless you ask. Do your research and understand what is offered to you. To get you started, here are a Helpful hints few of the best discounts for teenager motorists that will help you get automobile insurance coverage that you can pay for.

Not all of these discounts can be used at the same time or combined together. So make sure you fully comprehend what is and isn't accepted by your insurance company. Excellent Student Discount: Basically, if your teen reveals good grades and responsibility in school, they get a break on the rate of cars and truck insurance coverage.

Student Away Discount Rate: If your teenager is away for school and not driving, ask your carrier about an "away" discount rate. This can save you around 5%-10%. Raise Your Deductible: This just suggests you raise the quantity that you are accountable for covering in case of a mishap and is an easy method to lower car insurance coverage premiums.

Everything about Car Insurance Information For Teen Drivers - Geico

Be sure to ask your agent about the time durations and when this ends up being offered to the motorist. Be sure to talk to your teen about safe driving routines and be sure you model those safe driving habits to them.

Sadly, South Carolina has a few of the most distracted chauffeurs on the roadway! South Carolina ranks in the top 5 in the nation for fatalities per 100 million vehicle miles traveled. 982 individuals passed away in traffic mishaps on our state roadways in 2017. That equates to one death every nine hours.

It might not seem reasonable that your insurance is so pricey, specifically for your first policy, however we thought it would be a good start to discuss why. All insurance quotes and premiums are based upon danger. Your insurance company examines the possibility of paying out for a claim and price your premium on this danger.

Federal government statistics suggest that 1 in 5 young chauffeurs are associated with a mishap within the very first year of passing their test * - that's a lot of threat for insurers. Insurance companies will estimate premiums based on the probability they will need to cover the cost of more claims than a more knowledgeable driver.

Little Known Facts About Finding The Cheapest Car Insurance For Teens - Nerdwallet.

Even teens with clean accident records will deal with high automobile insurance coverage rates for several years due to their absence of driving experience. At age 25, rates generally begin to decrease, and middle-aged motorists take pleasure in the very best rates. It isn't till about age 65 that rates start to sneak back up once again (see chart below).

https://www.youtube.com/embed/onNEwJ6grFc

Typical rates are shown for a policy with protection of $100,000 physical injury per individual per accident, $300,000 bodily injury for mishap, $100,000 property damage per mishap., however buying a cars and truck for the teenager and putting him on his own policy isn't one of them.

AboutWhat Age Does Car Insurance Go Down? - Coverage.com for Beginners

If your teen drives your car and is a restricted user, ask whether the kid qualifies as an occasional chauffeur. If the kid is an university student studying away from home, discuss that he or she just drives on holidays. If your teenager drives a separate automobile rather than shares yours, consider purchasing an older design that is low-cost enough to bypass accident and comprehensive protection.

Insurance providers frequently assume that even if the teenager has a cars and truck, he or she might drive the other family cars from time to time. It will charge a greater rate to cover all the cars. Nevertheless, it may be cheaper to add the teen's automobile to your policy if you can get a multi-vehicle discount.

This could save some cash. If you are changing companies, inquire about offered discounts. Saving money is admirable, it can prove pennywise and pound foolish if you're under secured. Constantly think about a complete protection package with $100,000 liability coverage for other injured in a mishap with a minimum of $300,000 per accident.

Not known Details About Teen Car Insurance - Usagencies

You ought to also think about buying an extra policy in addition to car insurance, a move that will provide you added defense. Umbrella policies are extra protection, covering liability in excess of what is normal in basic automobile policies.

You can likewise inspect the Insurance coverage Institute for Highway Security's list of safe vehicles for teenager drivers. Buying an older safety-rated cars and truck can save cash if you insure it separately since it is often useful to skip accident and comprehensive protection, Why It's So Expensive to Include a Teenager to Your Vehicle Insurance Coverage Policy, Teenagers are incredibly pricey to guarantee due to the fact that they are, as a group, the most accident-prone motorists on the roadway.

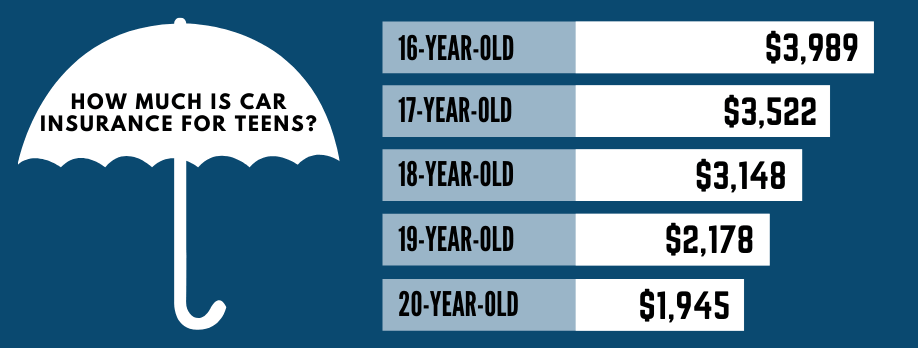

Insurance rates fall for each year a teenager grows older. 5 times greater than for chauffeurs aged 18 and 19.

How Best Cheap Car Insurance For Teens Of October 2021 - Forbes can Save You Time, Stress, and Money.

Moms and dads and guardians shouldn't forget how vulnerable new chauffeurs are and need to take some time and have perseverance advising their children as they discover to drive. You must stress the danger of drinking and driving, tell them not to have more than one minor guest in the vehicle at a time and not to talk on a mobile phone or text when behind the wheel.

Teens as a mate continue to be accident prone and as long as that's the case, insurance coverage rates will reflect the higher threat they pose on the roadway.

Including a young motorist to your vehicle insurance coverage can escalate the rate by thousands of dollars each year. To save cash, you need to take your time to discover the very best vehicle insurance coverage for teenagers. In this short article, we will take a look at the process of getting protection for your teen and examine the finest vehicle insurance companies for teenage motorists.

The Greatest Guide To How To Save On Teenage Car Insurance: What You Need To ...

Being such a high-risk market normally indicates teenagers pay higher rates for automobile insurance coverage. The very best way to discover budget-friendly car insurance coverage for a 17-year-old is by putting them on a parent's policy and search for trainee and young chauffeur discounts. Due to the fact that 18-year-old motorists don't have much experience behind the wheel, these chauffeurs are considered high-risk.

According to The Zebra's State of Vehicle Insurance coverage research study, the average car insurance for 18-year-old drivers runs about $4,700 annually or nearly $400 per month. The exact same research study goes over the cost savings 18-year-olds can see if they remain on their parents' insurance coverage instead of starting their own it has to do with $2,600.

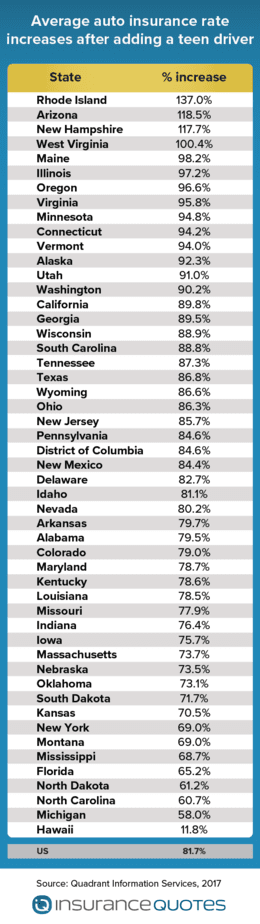

Teenage motorists pay some of the greatest rates, though there is a big difference in between the average expense for 16-year-old and 19-year-old drivers. According to Forbes, adding a teen chauffeur to a married couple's cars and truck insurance coverage increases rates by approximately 79 percent. However that number falls to about 58 percent once the chauffeur turns 19 years old.

The 20-Second Trick For Auto Insurance For Teen Drivers - Allstate

* You might observe that some cars and truck insurer are listed above those with greater star rankings. This is because our scores consider across the country factors, while our ranking for this article looks specifically at what cars and truck insurance service providers are best for teens. Liberty Mutual has the best car insurance coverage for teenagers since of its thorough coverage and benefits.

State Farm is a leading company of automobile insurance, as well as insurance for bikes, boats, ATVs, motorhomes, and more. State Farm has some of the finest cars and truck insurance coverage for teens thanks to its terrific programs for trainees and young motorists.

Motorists younger than 25 with no at-fault accidents or moving violations in the past 3 years who finish this driving training program could save as much 15 percent on their policy. If you are a student under the age of 25 and move away to school without bringing your car, get a discount rate on your cars and truck insurance coverage rates.

The Best Strategy To Use For Adding A Teenager To Your Car Insurance Policy - Debt.org

To learn more, read our complete State Farm insurance coverage review. USAA made the greatest scores in general in our market review for all chauffeurs, and teens can get great rates too. If you are presently gotten or part of a military household, it makes good sense to use this supplier for your teen's insurance requirements.

In truth, the coverage doesn't end when your kid moves away from house and is all set for their own policy. USAA has a 10-percent Household Legacy discount rate when the time comes for your child to get an individual policy. Read our USAA insurance review for more information about why this company has a few of the very best cars and truck insurance coverage for teenagers.

It is one of the leading insurance providers in the country. Geico preserves an A+ BBB score, and it also fared well on the very same 2021 J.D. Power study pointed out above. As a few of the very best car insurance for young people, we like Geico for its long list of discount rates and incentives.

Excitement About Six Tips To Save On Teen Driver's Car Insurance - Icne

Auto Insurance Research Study, however the benefits this company uses make it a top competitor for the best cars and truck insurance for teenagers. Progressive is one of the biggest insurance providers in the nation and has actually stayed in business given that 1937. It presently sits in 74th location on the Fortune 500 list.

https://www.youtube.com/embed/OM8l6fuzg_c

Some benefits to using Progressive when choosing automobile insurance coverage for teen motorists include: Discount Particulars Only pay for protection when the vehicle is in use (i. e. if your kid goes away to school without the lorry). Get lower premiums if your teenager preserves a B average or higher. Save cash when you insure multiple cars.

AboutEverything about 9 Benefits Of 6 Months Car Insurance Premiums (2021) - Insurify

Some auto insurance coverage providers comprehend this and accept it. As such, they want to neglect the first mishap a chauffeur has and won't increase your premiums. The information of a mishap forgiveness clause vary from supplier to service provider to company. Some will automatically offer accident forgiveness, while others require that the insured has no accidents for a period of 3 or five years before allowing this provision to go into impact.

Take a Driving Course Taking a driving course could minimize your premiums after an accident or a ticket. Your insurer may view it as you are taking an interest in enhancing your driving abilities. If they do, they might want to reduce your rate when it comes time to renew your policy.

All about Speeding Ticket And Insurance - Root Insurance

This is a good way how to reduce car insurance after a mishap or ticket. Nix Collision Coverage One of the most efficient methods to lower your automobile insurance premiums after a ticket or an accident - or any other time - is by eliminating your crash coverage.

Before you decide on this option, make sure you figure out if you are able to shell out more cash in the event that you do get into an accident in the future. Inquire about Discounts The majority of automobile insurers use discount rates to their policy holders. Some vehicle insurance coverage discount rates that may be available to you consist of low mileage driving (you drive less than 5,000 miles a year) and a devoted client discount rate.

The Ultimate Guide To How A Driving Ticket Affects Your Auto Insurance Premium

/shutterstock_240208012_1.car_.insurance.cropped-5bfc3b7c46e0fb0051c1f999.jpg)

That's not necessarily the case. Do some research to find out if there is another supplier who is prepared to use you a lower premium, regardless of your mishap or ticket. Keep in mind that cars and truck insurance provider are excited to attract brand-new clients, and one method they can do that is by using the very best rate possible.

Noted listed below are other things you can do to reduce your insurance expenses. 1. Search Rates differ from company to business, so it pays to look around. Get at least three cost quotes. You can call companies directly or gain access to details on the Internet. Your state insurance coverage department may likewise provide contrasts of prices charged by major insurers.

3 Easy Facts About A Speeding Ticket In Georgia Can Raise Your Car Insurance ... Shown

It is very important to pick a company that is solvent. Inspect the financial health of insurance coverage business with ranking business such as AM Best () and Requirement & Poor's (www. standardandpoors.com/ratings) and seek advice from customer magazines. Get quotes from various types of insurer. Some offer through their own agents. These agencies have the very same name as the insurer.

Do not shop by cost alone. Contact your state insurance department to discover out whether they supply info on consumer grievances by business. Select a representative or company agent that takes the time to answer your concerns.

4 Simple Techniques For That Texting-while-driving Ticket Can Also Lead To A Car ...

Prior to you purchase an automobile, compare insurance expenses Before you buy a new or used cars and truck, inspect into insurance coverage costs. Vehicle insurance premiums are based in part on the cars and truck's cost, the expense to fix it, its overall security record and the possibility of theft.

Evaluation your coverage at renewal time to make certain your insurance coverage needs haven't altered. 5. Buy your property owners and car coverage from the very same insurance company Numerous insurers will give you a break if you buy two or more types of insurance coverage. You might also get a reduction if you have more than one automobile guaranteed with the very same company.

Not known Details About Shoppers' Guide - How To Lower Your Car Insurance Rates

Inquire about group insurance coverage Some companies provide reductions to motorists who get insurance through a group plan from their employers, through expert, company and alumni groups or from other associations. Ask your company and inquire with groups or clubs you belong to to see if this is possible.

Seek out other discount rates Companies offer discount rates to insurance policy holders who have actually not had any mishaps or moving infractions for a variety of years. You may likewise get a discount if you take a protective driving course. If there is a young driver on the policy who is a great student, has actually taken a chauffeurs education course or is away at college without a car, you might likewise get approved for a lower rate.

What Does Speeding Tickets And Insurance Rates - Law Office Of Jeremy ... Mean?

The key to savings is not the discount rates, but the last rate. A business that provides few discount rates may still have a lower overall cost. Federal Person Info Center National Consumers League Cooperative State Research, Education, and Extension Service, USDA.

Whether it's speeding or something else, getting a ticket is a humbling experience. Not just are you stuck to an unexpected expense you have to pay, but then you get struck in another area - your automobile insurance boost. Today we're going to look at how to lower your vehicle insurance after a ticket.

The 5-Minute Rule for Can Speeding Tickets Increase Auto Insurance In Texas?

Why do my car insurance coverage rates go up because of a ticket? You can get a ticket for a range of reasons.

you get the concept. However to an insurance provider, if you have a ticket, it suggests a higher chance of getting in an accident one day. This is why your present insurer keeps an eye on your driving record. And a higher chance of an accident equates to a greater threat for the insurance provider.

Some Known Factual Statements About How Long Does A Ticket Stay On Your Insurance?

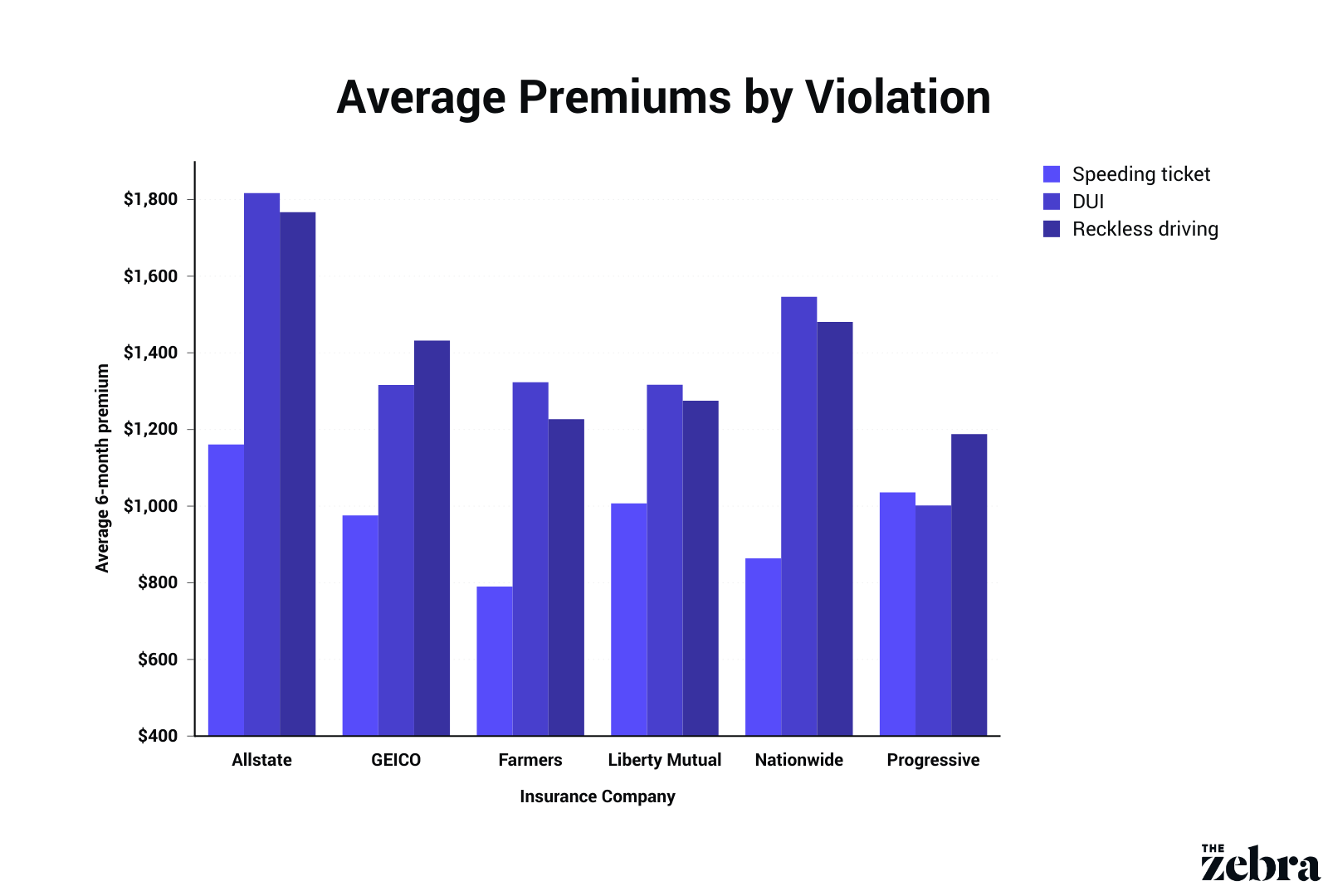

And that is available in the form of increased premiums. You may likewise be questioning how much of an increase to your premiums we're discussing here. Let's put it in this manner - it's not pretty. According to The Zebra, auto insurance coverage rates can increase as much as 82 percent. It depends upon the type of infraction you're ticketed for.

This makes it a lot more crucial to make sure you're getting as low of a rate as possible moving forward. The very best strategies to reduce your auto insurance Alright, let's get into why you're here. Here are methods you can utilize immediately to control the increased cars and truck insurance coverage expenses after a ticket.

The smart Trick of 8 Tips On How To Lower Car Insurance Premiums - The Hartford That Nobody is Talking About

Shop around When it comes to auto insurance coverage, it pays to shop around. The differences in between premiums from one auto insurance coverage company to the next can be substantial.

https://www.youtube.com/embed/oDSgq-z8JEU

such as Gabi or , that can compare several companies simultaneously for you. We'll go over Gabi in greater detail later on, however Gabi can save you a lots of time by comparing at least 40 various vehicle insurance coverage providers for you. Yes, going shopping for quotes will take a little time, but this can make one of the biggest effect on the amount you pay, even after a ticket.

About6 Easy Facts About Teen Car Insurance - Young Drivers Auto Insurance Explained

For this reason, it's a good idea to shop around for the very best price, however don't rely on this factor alone. another essential element when considering a young chauffeur insurance plan is the quantity of coverage provided. There is no one-size-fits-all policy; the aspects that influence the choice of just how much protection should be bought differ from individual to person.

For more youthful drivers, it is a good idea to have a greater level of protection, even if they drive a car that has already been paid for in full. Some are well touted for their attention to detail and excellent consumer service abilities, specifically when dealing with vehicle insurance coverage for young drivers.

everybody enjoys to save cash, and teens and their moms and dads are no exception. When looking for young motorist insurance, ask your representative about any qualifying discount rates that might be available. These can help drop the rates, sometimes significantly. The cost of guaranteeing young motorists There are several factors to consider that enter into the expense of guaranteeing young chauffeurs.

A Biased View of Best Car Insurance Companies For Teens Of November 2021

Usually, a longer driving history and clean record will lower rates. Many young drivers run with a license to drive personal lorries, however motorists with a license to operate larger automobiles such as busses and trucks with heavy towing capabilities may pay greater premiums for insurance coverage as their cars and towed products might cost more to cover.

- Moms and dads who decide to include their young chauffeurs onto their existing policy will see a boost in their general insurance premium. Nevertheless, it's easier for brand-new, inexperienced motorists to become guaranteed in this manner. The young chauffeur insurance policy expense will not increase as much if the child is driving mama or papa's cars and truck.

Opening a brand-new car insurance plan for teenagers isn't often suggested since of the high expense. Insurance provider consider these young drivers a greater danger and as such, it's not uncommon for a car insurance plan for teenagers to cost upwards of a thousand dollars each year. Numerous teens can't pay for these rates, even if they are working full-time.

The smart Trick of Teenage Car Insurance: What To Know - Trusted Choice That Nobody is Discussing

Saving on teen automobile insurance As with any young driver insurance coverage policy,. These discount rates are usually used to young drivers in between the ages of 16 and 24, though some insurance coverage agencies might have other ranges.

The amount or percentage marked down on automobile insurance for young drivers varies per firm, however it's worth making an inquiry. - loyalty discounts come as teenagers and young chauffeurs maintain their policies with a particular company or agent. The longer they keep a policy with the business and keep their account in good standing, usually the better the discount.

Even teenagers can qualify for safe chauffeur discounts on their insurance policy if they preserve an impressive record. You merely install it in the automobile and the tracker keeps track of the chauffeur's routines.

How To Save On Car Insurance For New Drivers [2021 Guide] - Truths

Any moms and dad who has actually looked at car insurance coverage for teen motorists understands the increased cost can be astronomical. There are a few aspects that add to that high price. The primary one is that teens are, usually, more risky to insure than older motorists. Teens aged 15-19 represented 6.

population, according to the CDC. Nevertheless, this same group made up 8% of the overall costs of automobile injuries (deadly and non-fatal). Teens are at high risk for a vehicle mishap because they are brand-new motorists, young, and may be more aggressive (particularly males). All of those elements add to high vehicle insurance premiums.

They'll simply require to get a couple of years of driving experience under their belt with no mishaps before reasonable insurance coverage rates are a reality. Here are the techniques and business that can assist you save.

How To Save On Your Teen's Auto Insurance - Cbs News Can Be Fun For Everyone

Of course, including your teenager to your personal policy will raise your own premiums. And you'll also be liable for any accidents that your teen gets into.

How To Save Money On Automobile Insurance For Teen Drivers, There are a few ways that you can lower the expense of automobile insurance coverage for teenager drivers. Initially, you'll wish to make sure to assign them to the cheapest car on your policy. If you among your automobiles deserves $500 and the $20,000, you certainly want to make certain that you're teenager is assigned to the $500 car.

For example, your insurance company may provide a "Good Grades" discount rate for high school and university student. Check out the cheapest cars and truck insurance for college trainees."Student away" discount rates can likewise decrease the expense of insuring trainees who spend a big part of the year at an out-of-state college separated from their car.

The Ultimate Guide To Best Car Insurance Companies For Teens Of November 2021

The Value of Shopping Around, To keep expenses low as possible, you'll wish to go shopping around. Your present insurer might not be the very best option when it comes to adding your teenager to your insurance. For one, your insurance company might not offer one or more of the discount rate programs listed above.

The price of car insurance coverage for teenager motorists will also differ depending on where you live and your teenager's gender (teen males will typically cost more than women to insure). Even if your insurance company typically offers low rates for automobile insurance coverage for teen motorists, a various business might still have the ability to use you a better rate if they offer short-term discounts to get brand-new customers in the door.

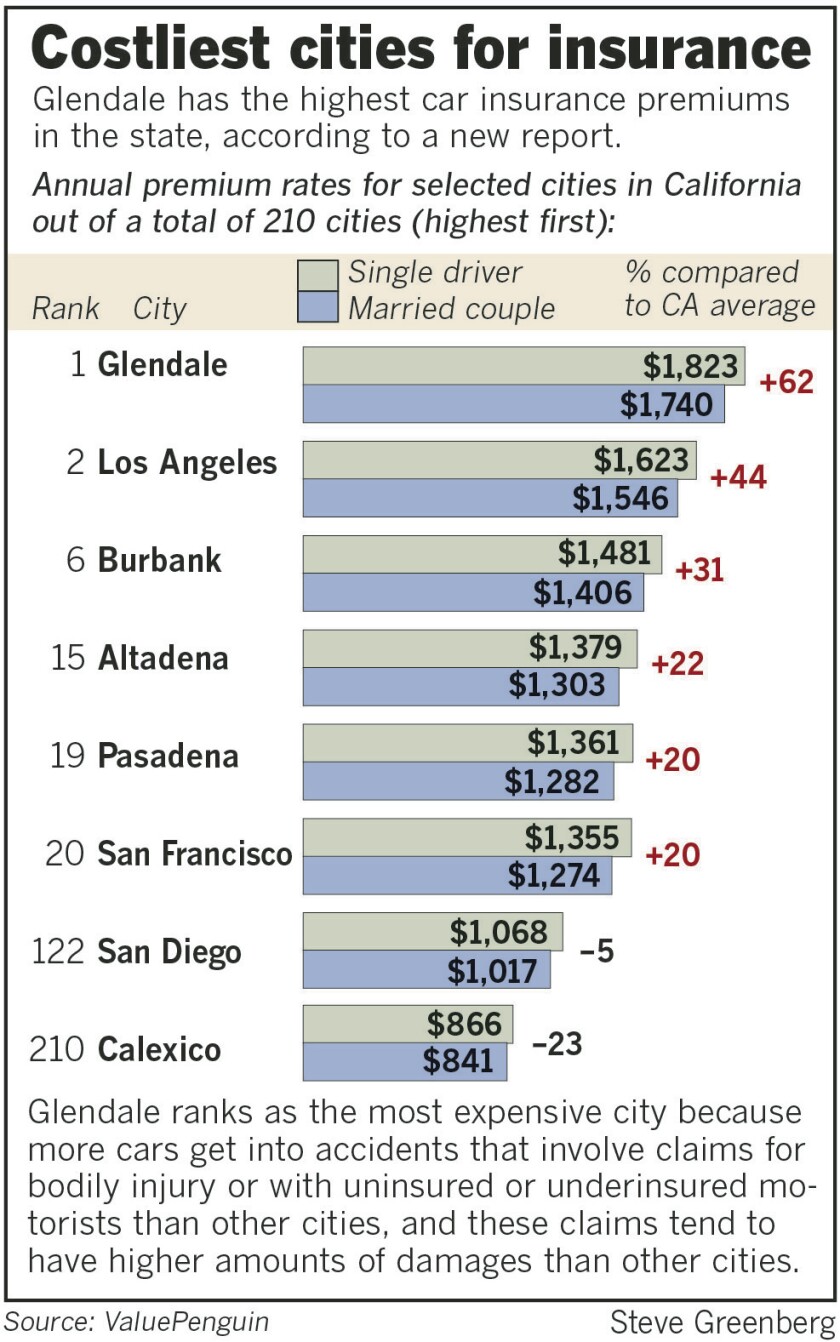

It definitely could be if the savings are large enough. Then once again, if you have actually had a fantastic experience with your insurance company and your potential savings from switching are very little, you might choose that sticking to the insurance provider that you've familiarized and trust is your best option.: 6 Ways To Save Cash On Automobile Insurance The Very Best Cars And Truck Insurance Coverage For Teen Drivers By State, Just Recently, Value, Penguin compared the expense of vehicle insurance for teen chauffeurs in numerous states.

Getting The Teen Car Insurance - Young Drivers Auto Insurance To Work

https://www.youtube.com/embed/GosWET3WsQgThis might offer you a starting point when doing your own insurance research. It is necessary to explain their research study only included insurers who were available in a minimum of three of the ten states. This indicates that small, local insurance companies weren't considered. While the data listed below can offer you an idea how the biggest gamers rank in each state, you may still desire to get quotes from smaller sized providers that are just offered in your location.

AboutThe Buzz on New York State Insurance Requirements

If you have money in cost savings or you own a house, consider adding more liability insurance coverage to protect these possessions from being taken if you are discovered at fault and the damages exceed your policy's max payout. On the other hand, if you drive an older cars and truck, you might wish to eliminate comprehensive protection from the plan given that it may not deserve the expense based upon the Visit the website worth of your lorry.

com, The Zebra, and Geek, Wallet all suggest a policy that consists of $100,000 in physical injury liability coverage and $300,000 per accident. This is described as 100/300 coverage. Cars And Truck Insurance Coverage Cost Factors, Your vehicle insurance coverage expense will depend upon several essential aspects, which will be reflected in the quotes you get.

Comprehending insurance coverage quotes and protection needs might be puzzling as a first-time vehicle insurance purchaser. Knowing some basic ideas for how to go shopping around and choose protections that best safeguard both you and your lorry is a great method to start the process.

All About 4 Tips For Buying And Insuring Your First Car - Geico

This info can normally be broken down into the following categories: Chauffeur (or motorists') information Vehicle info Insurance info First, you will likely be asked to offer personal info on your own and other drivers, if somebody else prepares to drive the car frequently. This information includes motorist name, date of birth and driver's license number (consisting of where it was released).

An insurance provider might likewise have an interest in if you have actually finished a safe driving course just recently. When it comes to your automobile, the details required is quite simple. Auto insurance providers generally need to know the year, make and design of your automobile as well as the VIN. Other questions may revolve around when the automobile was purchased, the signed up owner, where it is garaged or kept and its mileage.

If this is your first time ever having car insurance coverage, you will likely supply info about when you were under a parent's policy because most companies do not allow people to get their own policy prior to they are 18. How to get a cars and truck insurance coverage quote, With your information prepared, getting vehicle insurance quotes should be reasonably simple even as a first-time buyer.

Unknown Facts About Guide To First Time Car Insurance - Ratesdotca - Rates.ca

In addition, as you send for multiple quotes, making sure to input the exact same info throughout each company's sites might assist significantly in the contrast phase. For instance, if you include accident and comprehensive protection in your quote from one company, but not in others, your priced estimate rates could be off anywhere from a few hundred to a thousand dollars.

The minimum coverage required by your state, nevertheless, may not be adequate to offer you appropriate monetary protection. You might still be on the hook for big amounts of cash if you trigger an accident and you do not have crash insurance coverage to cover the repair work to your own vehicle.

Choose how much coverage you require, The amount of coverage you'll need will vary based on your age, where you live, vehicle type, miles driven, credit report and more. In addition to liability coverage, automobile insurance plan also use a range of different coverage alternatives as add-ons to the base coverage: covers you (and you passengers) if you sustain injuries in an auto mishap.

A Biased View of First Time Car Insurance: What You Should Know - State Farm®

It's various from your bodily injury coverage, which pays for expenses of those in the other vehicle following a mishap. covers you for damages brought on by an uninsured or underinsured motorists. This likewise covers you when it comes to hit-and-run mishaps. Some states require uninsured motorist protection. covers you if you are at fault for damages to your vehicle, truck or SUV sustained in a collision with another car or item.

Drop some protection, If you have an older car or a used car that's not worth much cash, it might not make good sense to bring a pricey insurance plan. As a guideline of thumb, it's unworthy having crash or comprehensive protection on a car that deserves less than 10 times the insurance premiums.

0 or above you will get a significant discount rate. Bundle your policy"Bundling policies, such as your auto and house or tenants insurance, is another excellent discount rate that first-time insurance coverage buyers must consider," according to Adams. Numerous business provide a discount rate if you have multiple insurance plan under the very same provider.

What Does How To Buy Car Insurance For The First Time - Valuepenguin Do?

Frequently Asked Questions, What insurance company has the least expensive rates? There is no one company that constantly has the best insurance coverage for first time automobile purchasers, because your rates will vary from business to company, and you'll want to get numerous quotes.

Buying vehicle insurance for the very first time can be difficult: there are several types of coverage that make up a policy, and knowing just how much you need can be difficult. Plus, novice chauffeurs tend to pay more for cars and truck insurance coverage because of their absence of experience, so discovering an affordable policy can take some additional work.

You likewise should purchase your cars and truck insurance policy before you buy a car, that method your automobile's guaranteed when you're ready to take it house. But be all set to pay a little bit more than an experienced motorist would for a policy. Getting your own policy might cost you countless dollars a year, while adding yourself to an existing policy will likewise raise the policyholder's rates (but might still be a more budget friendly alternative).

The smart Trick of How To Buy Car Insurance For The First Time - Policygenius That Nobody is Discussing

If you decide to get quotes on your own, you'll need to go to each insurance company's site and submit their application one-by-one. This implies the procedure can be time-consuming, and not every company provides online quotes. If you currently have a house owners or renters insurance coverage, you might have the ability to conserve by bundling your new automobile insurance plan with the exact same insurer.

Your minimum is just a beginning point for coverage, however, and inadequate to sufficiently cover you in case of a mishap, so you ought to set your limits well above the minimum. Let's say your state mandates a minimum of $25,000 in residential or commercial property damage liability and you trigger $35,000 of damage in an accident.

https://www.youtube.com/embed/I4ArgsnpYCw

If you can't manage to pay for the damage, your assets could be at danger. 3. Complete an application for automobile insurance coverage quotes, Whether you go through an insurance coverage market like Policygenius or choose to get quotes on your own, you will require some individual information on hand about you and anybody else you prepare to list on the policy: Names and birthdays, Chauffeur's license numbers Social Security numbers Lorry Recognition Numbers (VINs) or make and design years for all vehicles, An address for the insured (both where you live and where the automobile is garaged, which is normally the very same location)4.

AboutExcitement About The Cheapest Car Insurance For Teenagers - Business Insider

Method In an effort to provide precise and objective info to consumers, our expert evaluation group collects data from lots of automobile insurance suppliers to formulate rankings of the best insurance companies. Companies get a score in each of the following classifications, as well as a total weighted score out of 5.

Scoring a lot on car insurance isn't simple at any age, but when you're a young motorist, there's an included difficulty. Teenagers have less experience on the roads and are more most likely to get in accidents, so cars and truck insurance for teens tends to be expensive. Scoring a great rate is still workable.

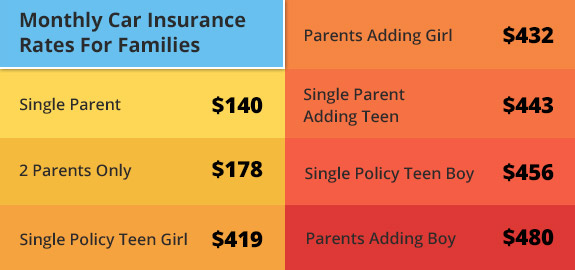

When it comes to car insurance for teens, young drivers pay more than their older, more experienced equivalents-- about $169 per month on average, according to our analysis. Teenagers 16 to 19 are nearly twice as most likely to experience fatal car accidents, according to the Insurance Institute for Highway Safety (IIHS).

Plus, insurer do not have as much information to look at when assessing how responsible a teen chauffeur is on the roadway. That signifies more danger to insurance companies, which is why vehicle insurance for teenagers is more pricey. Teenager male vs. female automobile insurance coverage rates, In our analysis, we found that male teen motorists pay about $20 more monthly than female teen drivers.

9 Simple Techniques For Teen Safe Driving Program & Discount - American Family ...

Teen males are more likely to get in wrecks. They've caused two-thirds of all accidents amongst teenagers 16 to 19 in the last few years, according to IIHS data. How to find low-cost insurance coverage for teens, The very best method to find inexpensive cars and truck insurance for teenagers is to compare rates from a number of business.

While they all consider teen motorists riskier to insure than older motorists, they don't all upcharge teenagers the very same amount. So the only way to see which uses a young driver the best rate is to compare quotes side by side. In addition to looking around, search for teen-specific auto insurance coverage discount rates, like the ones discussed listed below.

Another way to make vehicle insurance for teens more budget-friendly is to minimize their coverage levels. This is risky and might not even be possible. For example, a loan provider may not enable clients to get rid of accident and detailed coverage if they have a lease or loan on their vehicle.

This gives a teen driver the benefit of any discounts their moms and dads qualify for, like a multi-policy discount rate for bundling home and car and a discount for continuous insurance protection, that teenagers may not certify for on their own. Obviously, including a teenager driver implies higher rates for parents, so that's something each household has to think about.

9 Easy Facts About 5 Tips For Buying Car Insurance For Teenagers - Money ... Shown

There's no law about when a young chauffeur has to get their own insurance, but in most cases, if they're living individually, paying for their own costs, and driving their own lorry, they need to most likely have their own policy. Best automobile insurance coverage for teenagers, Here are some of the finest vehicle insurance service providers for teen drivers:.

1.

But the very best behaviors in fact arise from an early education, not just understanding how the credit video game works. Research study shows that children start developing their habits around cash as early as age 3 and they are almost solidified by age 7. Establishing great cash habits can be as simple as giving young kids home tasks to help them comprehend the idea of making money, Tim Sheehan, CEO & co-founder of Greenlight (and a daddy), tells Select.

In Gardner's book, among the characters, appropriately called Spender Bear, faces trouble when he purchases just what he wants. He needs to deal with the other bears to produce a spending plan that consists of saving, investing and donating money also."Spender Bear is high up on life till he spends too much and loses whatever," Gardner discusses.

Indicators on Best Car Insurance For Teens & Young Drivers - Wallethub You Should Know

2. Teach the difference between a debit card and a credit card, When your child is young, they will observe you swiping your card at the checkout, and they will quickly make the connection that a card is a lot like money. While a debit card is cash in essence, a credit card is borrowed cash.

Incentivize saving, Rewarding your kids for chores is more reliable when you incentivize saving, according to Sheehan, who developed the Greenlight app to help parents teach their kids how to properly utilize a debit card (which equates to responsible charge card usage later, states Sheehan)."With the Greenlight app, you can set up weekly tasks and connect that to a weekly or regular monthly allowance," explains Sheehan.

Jointly, the roughly 1 million moms and dads and kids who use Greenlight have put about $25 million in savings, or approximately $25 per kid typically. The parents who utilize the app's parent-paid interest feature see their kids saving more, and the kids are currently earning an average of 18% APY from their moms and dads' "bank," Sheehan states.

4. Help them conserve early for a secured charge card, If your teen is interested in opening their very first charge card at 18, you may wish to encourage them to save up the deposit required to open a secured credit card. In many cases, if you have a savings account at a bank or credit union, you can borrow against that account to open a protected card.

Facts About Car Insurance For Teens - Root Insurance Uncovered

If they do it right, they can continue to grow their savings while also building excellent credit. If you're not interested in joining a cooperative credit union, you might advise your kid obtain the Capital One Protected Mastercard. It sticks out because Capital One will evaluate cardholders' accounts periodically to give qualified borrowers access to more credit and to ultimately upgrade them to a unsecured card.

6. Have them report all possible forms of credit, It can be tough for a young person to establish credit, since 15% of an individual's credit report relates to the length of time they have actually been a borrower and their general monetary history. There is a rather new solution to this.

https://www.youtube.com/embed/h2V5LejYVW8

With services like Experian Boost, they can give the bureaus access to their "telecom and energy costs," states Griffin. This is a broad term for web, cable television and cell phone accounts, and utility accounts such as gas, electrical and water. As soon as a person consents to the service, all of their payment history, reaching as far back as two years from the time of signup, will be contributed to their credit report.

AboutHow Does An Insurance Company Determine Totaled Car ... Fundamentals Explained

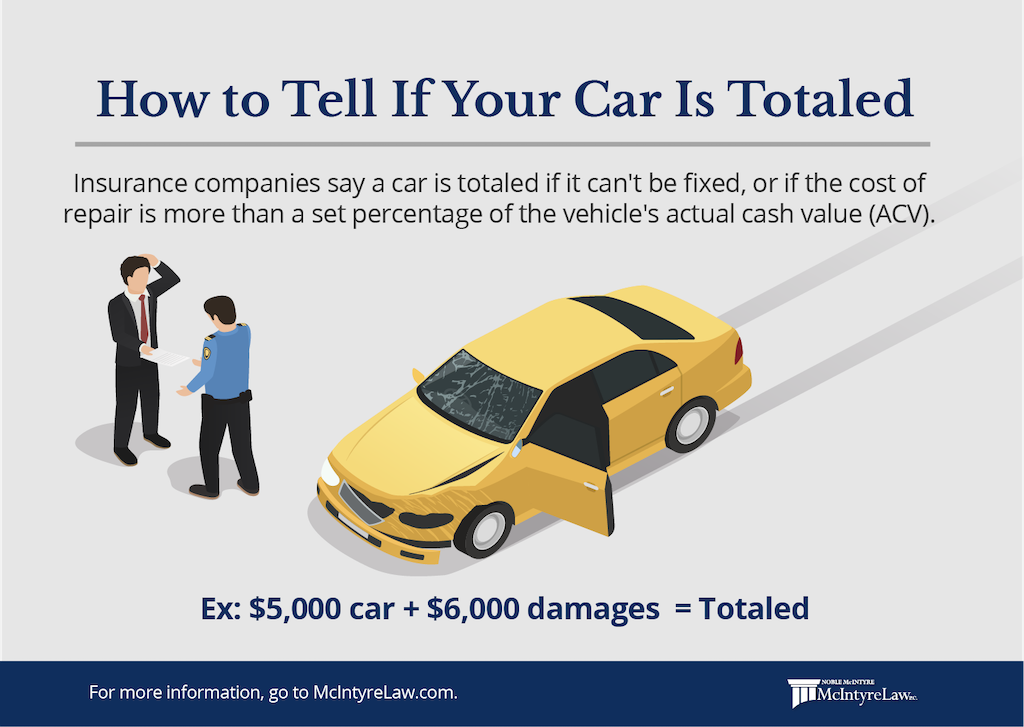

If this number equals or goes beyond the real cash value (ACV) of your vehicle prior to it was in an accident, your automobile will be totaled. If the number is available in lower than the ACV of your trip, the insurance provider might choose to fix it. These solutions, or a minimum of the numbers that are plugged into the formula, can differ by insurer which suggests that a person insurance provider may wind up amounting to the lorry while another might decide to fix it.

Your insurance business doesn't appreciate your fond memories, nostalgic accessory, or the reality that you might not have the ability to afford a new car. It's all business: The bottom line is that it is going to take the most inexpensive option. The requirements for deciding on totaling a car is different for every single insurer and in a lot of cases it is dictated by state law, but the standard formula is usually the very same.

However, due to limits that differ by state, an automobile may be totaled in one state and fixed in another. As an example, if your damaged Nissan Rouge is valued at $5,000 in Iowa you would require only $2,500 of damage to call it a total loss as the threshold in Iowa is 50%.

The smart Trick of What Happens If An Accident Totaled My Car? - Robotics ... That Nobody is Discussing

According to attorney Thomas Simeone, with Simeone & Miller, "Lawfully, the most an insurance provider is liable for is the real money value of the automobile at the time of the accident. Their decision will be based on whether it is less expensive to fix the cars and truck back to that condition or just write you a check and amount to the lorry."What happens after a mishap? Things initially, for your vehicle to be stated a total loss or be fixed through an insurance claim, you have to be carrying extensive insurance or accident coverage.

An appraiser will take a look at the car and calculate not just the expense of repairs but also your vehicle's pre-accident cash value, considering make, design, year, options, mileage and condition. If the automobile satisfies the needed threshold it will be amounted to. While total-loss limits may be mandated by state law, they hardly ever come into play.

Once your vehicle is totaled (and you are not combating the choice) your insurance company will probably need you to do the following: Eliminate the license plate, Get rid of all personal items, Offer your secrets to your claims adjuster, Notify your lender if you have a loan or lease on the automobile, If the mishap was not your fault a rental cars and truck ought to be covered, The last thing you need to do is begin looking for a new ride and perhaps a new insurer.

Facts About What Happens If An Accident Totaled My Car? - Robotics ... Uncovered

The majority of rented cars and trucks feature space insurance coverage included in the lease, which need to cover this gap, however most bank loans do not usually include this protection. It may be an excellent concept to put this protection in place till the vehicle stops diminishing faster than your loan. If you are unhappy with your insurance providers number, challenge it.

How much does insurance pay out for totaled cars and trucks: FAQFrom 2010, 2014 and 2018 claims data, the most recent offered, the Insurance Research Council has determined the following: How numerous claims lead to totaled automobiles? In 2018, 8% of detailed claims involved lorries that were totaled, about the like in 2010 and a little higher than in 2014.

Nearly half (47%) of the cost of all accident claim payments was because of total loss claims, up from 43% in 2010 and 42% in 2014, when representing the share of overall claim dollars paid, according to the IRC.Total loss cars were less common amongst residential or commercial property damage liability claims than in collision claims.

About Determining Your Car's Value And Cost Of Repair - Iii - Insurance ...

What is the average claims payout for amounted to cars and trucks? The typical payment for comprehensive claims with amounted to vehicles was $8,173 in 2018, more than 5 times the average payment of $1,496 among claims where the vehicle was not amounted to. the cost of amounted to vehicle claims has actually risen much faster than more small claims.

5%, compared with little change among detailed claims without a total loss. In regards to the percent of dollars paid, the share of dollars for totaled cars has actually risen from 24% in 2010 to 34% in 2018. The typical payment for accident claims with totaled cars was $10,484 in 2018, more than 3 times the typical payment of $3,286 amongst claims where the lorry was not totaled.

The average payment for residential or commercial property damage liability claims with amounted to vehicles was $6,625 in 2018, more than double the average payment of $3,130 amongst claims where the vehicle was not totaled. In regards to the share of overall claim dollars paid, almost one-quarter (24%) of the cost of all home damage liability claim payments was because of total loss claims, up slightly from 23% in 2010 and 20% in 2014.

7 Simple Techniques For Can I Negotiate A Car Settlement With An Insurer? - Law ...

Just 2% of cars newer than four years of ages were declared an overall loss, compared with 13% for automobiles older than eight years. For the claim years of 2010, 2014 and 2018 integrated, 34% of collision claims for vehicles older than 8 years resulted in a total loss, compared to only 15% of those with lorries 4 to eight years old and 8% with vehicles more recent than 4 years.

States where a total loss formula is utilized balanced a lower percentage of amounted to lorries in comprehensive claims. Oklahoma, where the total loss threshold is 60%, had the greatest portion of claims with totaled lorries (18%).

The states with the greatest percentage of collision claims with totaled cars were Kentucky (28%), Oklahoma (26%), and Tennessee (26%). State policies in both Kentucky and Tennessee set the total loss threshold at 75%; in Oklahoma the threshold is 60% (one of the least expensive in the country). The states with the greatest portion of home damage liability claims with totaled cars were Montana (19%), Kentucky (18%), and North Carolina (18%).

A Biased View of How Much Does Insurance Pay For A Totaled Car In North ...

What does it indicate if your vehicle is amounted to or stated a overall loss!.?.!? By definition, after an accident, your car will be damaged. Your insurance coverage business will do 2 things: They'll examine the amount of damage to your vehicle in regards to dollar worth. Somebody recognized by your insurance will check the damage on your cars and truck and provide a repair work estimate.

Relatively straight forward, no? If your automobile looks is a total wreck, it's probably a total loss. The truth is there are a lot of elements that come into play.

https://www.youtube.com/embed/jfz1-8mcNwo

While your insurance coverage's overall loss payout calculator can come up with a rate for your car, that's not the only option to move forward with. How can I get a quote for my TOTALED automobile immediately?

About8 Easy Facts About Buying Your Teen's First Car? Here's How One Money Savvy ... Shown

However, teens can take a number of steps to lower their automobile insurance coverage rates: The insurance company might provide your teen a discount rate for taking the course. Lots of classes can be finished online. Many insurance business reward drivers under the age of 25 if they bring a B average in high school or a GPA of a minimum of 3.

When shopping for the most inexpensive car to guarantee for your teen, keep in mind that there are other ways to save money on car insurance coverage. Nationwide 5 things to do prior to picking a cars and truck insurance coverage company for a teenager, Choose if you're getting a separate auto vehicle insurance coverage for your teen or if you want desire teen listed on your insuranceInsurance coverage Decide which car insurance coverage benefits are important to you, and make sure to view out for them when speaking to an insurance coverage representative.

AboutOur My Car Was Totaled In A Car Accident. Will I Get Paid Kelley ... Diaries

Your cars and truck will then sent to a salvage backyard for an auction by the greatest bidder and normally whacked up for parts. What If You Desire to Keep The Automobile? What can you do More help if you want to keep the car because you do not concur with the insurance company's assessment of the damages?

When you purchase a cars and truck insurance coverage, you sign an agreement that says that you can't make your insurance provider payment more than your vehicle deserves. In contrast, most states require insurance companies to follow the standards so you will be brought back to the same financial condition you remained in previous to the mishap.

Remember that you might not have the ability to buy crash protection and detailed protection on a rebuilt-title car. When the car has a salvage title, you'll likewise require to pay for comprehensive repair work to register it for roadway usage. If the insurance check for your totaled lorry is less than what you owe, you can conserve yourself and purchase gap protection when you purchase a new car.

Indicators on How Does An Insurance Company Determine Totaled Car ... You Should Know

It may be a great time to shop around for a brand-new vehicle insurance company. Our research shows that clients conserve approximately $390 each year when changing vehicle insurers. If you remain in the marketplace for a new cars and truck insurer, see who other motorists rate as the finest vehicle insurance provider.

Make your counter offer for your amounted to car. Conserve Cash by Comparing Insurance Prices Quote Compare Free Insurance Coverage Quotes Instantly Secured with SHA-256 File encryption The material on this website is provided only as a public service to the web neighborhood and does not constitute solicitation or arrangement of legal guidance.

You must always seek advice from an appropriately certified lawyer concerning any particular legal problem or matter. The comments and opinions revealed on this site are of the individual author and might not reflect the viewpoints of the insurance provider or any private lawyer.

Facts About What Happens When Your Car Is Totaled - Mcintyre Law P.c. Revealed

The insurer may wish to offer the automobile for the salvage value to recoup a few of its liability. You might request to keep the cars and truck, but the insurance coverage business might pay you less than your lorry's full worth. Below are other common concerns people have when the insurance provider informs them that their vehicle was amounted to in a cars and truck mishap.

Elements that are considered consist of: The retail value of a car that is the same make and design in a comparable condition to your vehicle before the crash, The mileage of the vehicle on the day of the mishap, The rate you paid for the vehicle, The worth of any enhancements made to the automobile after it was bought, Damage sustained before the accident The expense to buy a similar automobile on the existing market An insurance provider might use a range of sources to figure out the worth of your car.

You should have insurance covering your lorry till you return the license plates to the Computer System Registry of Motor Automobiles. Accident Claims After a Car Accident If you were not at fault for the reason for the auto accident, you could be entitled to payment from the at-fault driver. Injury claims are different from home damage claims.

All about Can I Negotiate A Car Settlement With An Insurer? - Law ...

Missing the due date might lead to losing your right to take legal action against the other chauffeur for damages.

A look at the lorry damage claim process and your options if you disagree with the insurer's valuation of your cars and truck. If you are making a automobile damage claim after a car accident, and the insurance provider states that the car is a total loss, what occurs next? What occurs if you disagree with the insurer's valuation? Does it matter which insurer you are handling-- yours or the other motorist's? Let's have a look at these and some related questions.

The answer to this concern depends on whether the accident occurred in a no fault state or a non-no fault state and what kind of coverage is being used to spend for your vehicle. No-fault car insurance coverage means that the insurer will pay for particular damages despite who was at fault (and regardless of whether anyone was at fault).

The 6-Minute Rule for Solving Totaled Car Insurance Problems – Forbes Advisor

And in any traditional fault state, liability in vehicle mishaps will always be based upon negligence. This suggests that insurers will just pay for automobile damage if someone was at fault, unless you have insurance coverage that will pay for car damage despite fault, such as crash coverage, which we'll discuss next.

Crash coverage can be quite expensive, since it spends for car damage no matter who triggered the underlying mishap. You can make a claim versus your own insurance company's crash coverage if you enter into an accident that is your fault. The bottom line is that, if your automobile accident occurred in a non-no fault state, the other chauffeur's insurer will only pay for your vehicle damage if the other chauffeur was irresponsible.

Keep in mind that if the accident occurred in a no-fault state, rules differ when it pertains to car damage claims, so you should examine your state's laws or consult a lawyer in order to identify which insurance provider is required to pay for your home damage. How Much Will the Insurance Company Pay? Insurers will just pay damages up to the policy limitations.

The Ultimate Guide To What Happens If You Total A Leased Car? (Answered)

Insurance-wise, the only method for you to get the remaining $15,000 of repair expenses would be from your own collision coverage, if you have it. What If the Insurance Provider States My Vehicle is an Overall Loss? If the insurance company says that your cars and truck is an overall loss, it will just pay you the reasonable market value of your automobile as of the day of the accident.

Let's look at an example of how this takes place. Let's say that, on the day that the vehicle was amounted to, you owed $14,500 on your vehicle loan, but that the present reasonable market price (i. e., the Blue Book worth) of your vehicle was only $12,000. The insurance provider is just going to pay you $12,000 toward the worth of the vehicle, leaving you with $2,500 to pay on your vehicle loan, despite the fact that you no longer have a cars and truck.

Even more, if an insurance company states your automobile to be a total loss, the insurance company has the legal right to take your vehicle so that it can offer it on the secondary market and recover a few of its losses. It is possible to convince the insurer to let you keep the vehicle, however it's not most likely.

The Best Strategy To Use For Totaled Loss Car Insurance Settlement: How To Get More For ...

https://www.youtube.com/embed/GvF_5-1YwDo

What If I Disagree with the Insurer's Assessment of My Damages? If you disagree with the insurance company's assessment of your damages, your only real options are to accept it, try to negotiate even more with the insurer about the figures, or submit a suit. Regardless of whether you wish to negotiate or sue, you will require to have some basis for disagreeing with the insurance provider's figures.

AboutWhat Happens If The At-fault Party Isn't Insured? - Langdon ... - An Overview

The chauffeur will buy the bond for the amount required by the state. If there is a mishap, the bond covers the expenditures up to its limitation. The chauffeur then must pay back the cash paid. The bond is associated with the drivernot the carso that the bond buyer can drive any vehicle.

Frequently Asked Concerns (FAQs) Why is car insurance needed? The main reason that automobile insurance is obligatory is to secure the victims in a mishap.

What is the minimum required vehicle insurance in a lot of states? A lot of states require liability protection for bodily injury and residential or commercial property damage, which covers the other chauffeur if you're at fault in a wreck.

/can-a-not-at-fault-claim-raise-my-insurance-rates-527469-final2-1396e7846dab4ca7b7548f81f829149b.png)

A lender desires to ensure its collateralin this case, your cars and truck is protected. At a minimum, many loan providers will need you to bring extensive and accident protection till your loan is settled.

The smart Trick of What Happens If You Get In A Car Accident Without Insurance? That Nobody is Talking About

In this post: The idea of having automobile insurance coverage when you don't own a cars and truck might sound silly, however there are times when it's the clever thing to doeven if you do not plan on driving. If you do not own a cars and truck, you'll still need auto insurance coverage if you want to drive while taking a trip, for example, or desire to avoid your future rates from surging due to a lapse in protection.

Depending on your insurance strategy, non-owner insurance might likewise consist of medical payments protection (in some cases called personal injury defense), which covers medical and other expenses if people in the car you're driving are injured in a mishap. It may consist of uninsured/underinsured vehicle driver liability insurance, which can help pay medical expenses and other costs if the other motorist does not have adequate insurance coverage.

Non-owner automobile insurance only covers liability; it doesn't include collision or detailed insurance coverage, which cover damage to or theft of the lorry you're driving. That's since crash and comprehensive protection are priced based on the specific automobile you drive.

If you have actually had a major moving offense, such as driving while intoxicated, the court may require you to carry non-owner insurance coverage to keep your motorist's license. The insurance coverage company will file what's called an SR-22 document (or an FR-44, in Virginia and Florida), certifying that you have the minimum insurance needed by the state.

The 2-Minute Rule for Mandatory Insurance - Faq - Adot

Insurers like to see a record of continuous care insurance protection. A break in your coverageeven if you didn't own a cars and truck during that periodcan make it harder to get vehicle insurance coverage later on or make it more expensive. If you travel regularly and lease vehicles on your trips, you might desire non-owner insurance coverage.

The owner of the vehicle in concern must include you on their policy to ensure you're covered should you borrow their cars and truck. Although these services might provide restricted insurance protection in specific situations, they generally concentrate on damage to the vehicle instead of injuries to yourself or others. If you utilize car-sharing services often.

Without a motorist's license, you can't get a non-owner policynor must you be driving. Your own car insurance will typically offer minimal coverage when you obtain somebody else's car or drive a rental car. (Talk to your insurance company to be sure prior to you struck the roadway.)How Much Does Non-Owner Vehicle Insurance Coverage Expense? Non-owner vehicle insurance coverage generally costs less than what you would spend for the same coverage on a car you own.

Insurance providers need to think about how pricey the car is to replace or repair. With non-owner car insurance, your driving history is the most crucial aspect in determining your premiums. The rate for non-owner insurance coverage can also differ depending on your age, how often you prepare to drive and other factors that might flag you as high-risk in the eyes of insurance companies.

The Main Principles Of What To Do If You're Hit By An Uninsured Or Underinsured Driver

Keeping accounts open also extends the length of time you have actually had credit, which is another consider your credit rating. Is Non-Owner Car Insurance Coverage Right for You? If you don't own your own cars and truck but regularly drive your buddies' automobiles, utilize car-sharing services or lease cars, non-owner vehicle insurance coverage can provide extra protection.

Discover what occurs if another person drives your vehicle and enters a mishap. There are times in life when we need to let someone borrow our automobile, however we hesitate permitting them to utilize it due to the fact that we don't know if we can, or if we should. We question: Can my babysitter utilize my cars and truck to drive my kids to the swimming pool? Can my pal drive my vehicle? Can my brother-in-law or other household member obtain my automobile for the weekend? Can I drive another person's car? Will my pal's insurance coverage cover any damages I trigger while driving their car? Do irregular drivers need to be contributed to my policy? At the heart of it, we need to know, "If we provide permission and they enter into a mishap, is it covered by my insurance? Is it legal for somebody to drive my automobile who is not on my insurance plan?" "Normally, it's not an issue if they're driving with your permission," says Jeanne Salvatore, Senior Citizen Vice President of Public Affairs and customer spokesperson for the Insurance Details Institute.

It depends upon your insurer and your particular policy. For example, coverage guidelines and policies may be various if the motorist resides in your household and could, or should, be noted as a named guaranteed on your policy, but is not; or, if the chauffeur is listed on your policy as left out.

https://www.youtube.com/embed/IZFVTDcAKlg

Generally, even if the individual driving your automobile has his or her own insurance coverage, your insurance coverage will be the main payer for damages triggered by your automobile; but, the person driving your vehicle has to be found lawfully at fault before your insurance coverage will pay. The driver's insurance coverage is secondary and may cover some personal injury or medical costs.

AboutThe 25-Second Trick For If You're In A Car Accident And You Don't Have Insurance - Nolo

How do you get cars and truck insurance when you are uninsured? You may not be eligible for the least expensive premium because driving without insurance puts you in a higher-risk classification.

As a primary step, have a look at major car insurance companies, such as Geico and Progressive, because they provide really competitive rates and protection can be bought online or through representatives. Likewise, check out regional insurers that provide protection in your state who might be more willing to ignore your faults and offer reasonably priced protection.

What are my state's minimum requirements for insurance coverage?

A Biased View of Do You Have Health Insurance? - Samhsa

Here's how it works. Crash coverage has a deductible that need to make money prior to the insurance coverage company will cover any repair work. Deductibles typically vary from about $250 to $1,500. When you buy a policy, you get to choose the quantity that's right for you. Increasing your deductible normally reduces your premium and vice versa.

Not sure how much your vehicle's worth?, which shows you the present market value of your car.

According to the Insurance Coverage Information Institute, the typical cost of collision protection has to do with $290 per year. But the price can differ substantially based upon several factors, including your age, the type of vehicle you drive, your driving history, where you live, and much more. To learn exactly just how much you would need to pay to get crash protection for your vehicle, you'll require to get an insurance quote.

The Can My Car Insurance Company Cancel My Policy If I Pay Late? PDFs

If you don't carry collision insurance coverage, what occurs will depend on several elements. If you're in an accident and another chauffeur is at fault, their insurance coverage business should pay for the damage.

Motorists with tidy driving records frequently certify for lower rates than chauffeurs who have moving offenses. Individuals with greater credit ratings typically qualify for lower insurance rates.

Keep in mind, accident insurance only covers the expense of lorry repair work. If you're in a mishap and your car is undrivable, you'll have to pay for hauling and a rental automobile if your policy does not cover these costs. You might want to consider adding this kind of protection to your policy for extra security if you don't already have it.

Lapse In Coverage: Penalties By State - Carinsurance.com Fundamentals Explained

Life can obstruct of essential due dates even your cars and truck insurance payments. If you've heard the term "car insurance grace period" thrown around, it typically refers to one of 2 things: making exceptional payments on time or getting car insurance coverage for a new lorry. In both cases, you never want to drive without a vehicle insurance plan, whether your plan has lapsed or you have yet to set it up.

Understanding a business's automobile insurance grace period might likewise be a selling point when selecting a new company. We'll lay out a few of today's finest car insurance companies, so you understand the best circumstance for you. Enter your zip code below or call to begin collecting quotes.: What Is A Vehicle Insurance Grace Duration? A vehicle insurance coverage grace duration is the amount of time your insurance company or your state laws enable you to either delay spending for your car insurance coverage premium without a lapse in coverage, or the time in between purchasing a brand-new vehicle and automobile insurance coverage for that vehicle.

Will the business cancel your strategy if you do not pay your car insurance right on time? It depends. Both private policies and state laws set specific guidelines on the length of time you can postpone payment prior to your car insurance coverage is canceled. In many cases, your automobile insurer is allowed to cancel your strategy after one day without payment, and your plan will lapse because of a non-payment, leaving you uninsured.

Not known Facts About Is It Illegal To Drive Without Insurance And What's The Penalty?

If you presently have auto insurance on a cars and truck, you usually have a grace duration of seven to thirty days before you have to report your new cars and truck to your insurer with or without a penalty. Some states require cars and truck insurer to offer a written letter with the intent to cancel your plan prior to doing so.

Some business might even likewise enable a particular variety of late payments prior to implementing more stringent regulations such as if you're late on your payments 3 months in a row. Other companies might charge a late charge or set a higher premium the next time you restore your vehicle insurance coverage. Most business do not want to lose you as a client over one late payment.

How Long Is A Cars And Truck Insurance Coverage Grace Period? All however two states (New Hampshire and Virginia) need some type of car insurance at all times, and even those require confirmation to drive without insurance coverage from the DMV.

Some Known Facts About What Happens If You Get Caught Driving Without Insurance?.

What about vehicle insurance grace periods when you're including a brand-new car to your policy or purchasing an automobile without an existing strategy? There are 3 things that come into play in this case: The rules of the car dealership Your state auto insurance coverage laws Your cars and truck insurance coverage company For example, some companies will enable you to drive off the lot with your new vehicle if you have insurance coverage for another vehicle.

https://www.youtube.com/embed/6Dovyu0tdz8

Lots of vehicle dealerships merely require a chauffeur's license and proof of insurance coverage to buy a car. In this case, what the dealership states goes. Above all else, you should also consult state laws about cars and truck insurance grace durations. Some states might allow you to extend your current coverage from another lorry to the brand-new vehicle for numerous days.

About6 Simple Techniques For California Driving Without Insurance - Mcelfresh Law - San ...

If you are in an automobile accident with no insurance coverage in Texas, the authorities will likely offer you a ticket. They may have your automobile towed or ask you to set up for someone with proof of insurance to drive it away from the scene.

If this occurs, you will need to pay a fee and reveal proof of insurance to get your vehicle back. Exist Lawbreaker Penalties for Driving Without Insurance? The majority of people who remain in an accident and have no insurance will at least receive a ticket from cops and have to pay a fine.

If you have a previous offense, your fine might be as high as $1,000. The state might also suspend your license as long as two years as a part of your sentence for a repeat offense. It is necessary to note that you might likewise deal with other charges related to the accident if you were at fault or contributed to the crash, no matter if you have insurance coverage or not.

You may get a ticket and have to pay a fine for failure to yield if you turned left in front of oncoming traffic. You may get a similar ticket if you ran a red light or were speeding. In some situations, you might deal with a lot more severe criminal charges related to the mishap.

Rumored Buzz on Car Accident Without Insurance Not At Fault Florida - Carey ...

Not bring automobile insurance can likewise position a problem if the other chauffeur caused the accident. While a lack of insurance does not make you accountable for the wreck, you can expect the insurer and the at-fault chauffeur to say you acted negligently and without regard to your legal obligations.

Alternatives to Driving Uninsured, There are methods to lower the general expense of a car without skipping insurance coverage. Ask About Discounts, It's possible there are discounts offered you weren't knowledgeable about when you signed up. Some insurance companies use discount rates for: Military members, Trainees with favorable grades, Credit report, Positive payment history, Acceptable driving history Many insurer are likewise offering low-mileage usage discounts since more people are working from home or spending less time on the roadway.

Look around Hang out making calls and searching for much better prices. Each insurance provider utilizes its own rates formula, which suggests some suppliers will provide much better rates than others. Likewise, numerous suppliers provide discounts for various types of insurance together. Nationwide provides a 20% discount rate for clients who bundle home and car insurance together.

/Insuring_Your_Car-42b77ff9ab8f4f4e88c0be99031a3d12.png)

Work out With Your Insurance Company, Try calling your insurance business and asking for a lower premium. Explain your financial circumstance and show that you've been a good customer in the past.

Do You Need Auto Insurance If You Don't Own A Car? for Dummies

It is necessary to have these discussions prior to you fall back on any premium payments, specialists state. Pro Tip, Ask your supplier what discounts they use. Some insurance coverage providers provide discount rates for military members, students with favorable grades, credit rating, favorable payment history, and excellent driving history. Downgrade, Get a cheaper automobile.

Each state has its own minimum protection requirements chauffeurs are expected to follow. Driving without vehicle insurance coverage is unlawful in 48 states. The 48 states that mandate vehicle insurance need individual liability insurance, including bodily injury and property damage coverage. Some states also require uninsured/underinsured motorist coverage, and in no-fault states, drivers require Accident Defense (PIP).

Even in these 2 states, drivers aren't completely off the hook. Chauffeurs in Virginia should pay an uninsured motorist cost of $500 if they choose not to buy car insurance. In New Hampshire, motorists who decrease vehicle insurance coverage consent to assume 100% of the monetary obligation for any damages they trigger in an at-fault accident.

"In addition to possible arrest, prison time, fines, and impound charges for absence of car insurance, the state may suspend the registration of cars and trucks without insurance," includes Cox. Drivers will likewise need to pay sky-high insurance coverage rates when they eventually buy a policy. "If a driver is caught operating a car without sufficient insurance coverage, he or she is unlikely to discover affordable insurance rates in the future," says David Clark, accident lawyer at The Clark Law Workplace in Michigan.

Some Ideas on What Happens When The Other Driver Doesn't Have Insurance? You Should Know

If you are at fault and uninsured, the other party's insurance coverage will attempt to collect from you the quantity they paid out."If you get into a mishap and you do not have insurance, you're going to pay a big fine, your lorry will get towed, and you could lose your license, among other things.

https://www.youtube.com/embed/O-zKKjpf3o4

If You're Picked up Driving Without Insurance coverage, Driving without cars and truck insurance coverage is illegal and something we do not motivate. If you choose to drive uninsured and get stopped by law enforcement, it's important to understand what to do in the scenario."The very first thing you must do, if it's safe, is to call and let somebody understand that you have actually been dropped in case you are apprehended," states Cox.

AboutExcitement About Will Auto Insurance Pay Me If My Car Is Stolen?

It's nowhere to be seen. You frantically look every which method prior to calling 911. By the time the police show up at the scene, you are trying to keep in mind as lots of details as you can about your vehicle, and are expecting its safe return. What would you do if your automobile was taken? Do you understand how the stolen automobile insurance coverage claim process works? Through the confusion and adrenaline rush, you need to stay calm and think plainly.

After you make a claim, some insurance companies have a waiting period since they want to see if the stolen vehicle can be recovered. Any individual products inside your taken cars and truck will not be covered by automobile insuranceyou would require a house owner's or tenant's insurance policy. Does Insurance Coverage Cover Your Stolen Cars And Truck? Typically, you should hold detailed coverage on your insurance coverage to have coverage for a stolen car.

The time duration normally starts at the time the automobile was stolen and not when you submitted the claim. The minimum waiting duration in between when your vehicle is stolen and when you can file a claim depends on your insurance company.

Making A Claim If Your Car Or Its Contents Are Stolen - Citizens ... Can Be Fun For Everyone

Stolen Vehicle Insurance Claim Investigation Theft claims, whether they remain in relation to your vehicle or belongings, are always investigated completely by insurance adjusters. Be prepared for recorded conversations with the claim adjuster as part of the business's standard operating procedure. Do not take the concerns personally. It is the adjuster's task to be on the lookout for deceitful claims.

You will require to come to an agreement with the insurance coverage adjuster regarding the present worth of your vehicle minus your deductible. After a contract is made, you will require to have your loan provider, if you have a loan, sign off on the title. You require to sign the title over to the insurance company.